The core philosophy of YNAB revolves around intentionality and proactive choices. You must decide where money goes before spending actually happens. This approach transforms the bank balance from a mystery into a roadmap. Every dollar gains a specific mission within a larger financial strategy. You stop wondering where the money went and start telling it where to go. This guide explores the vital process of assigning every dollar a unique job today.

Master the Core Principle of Budgeting

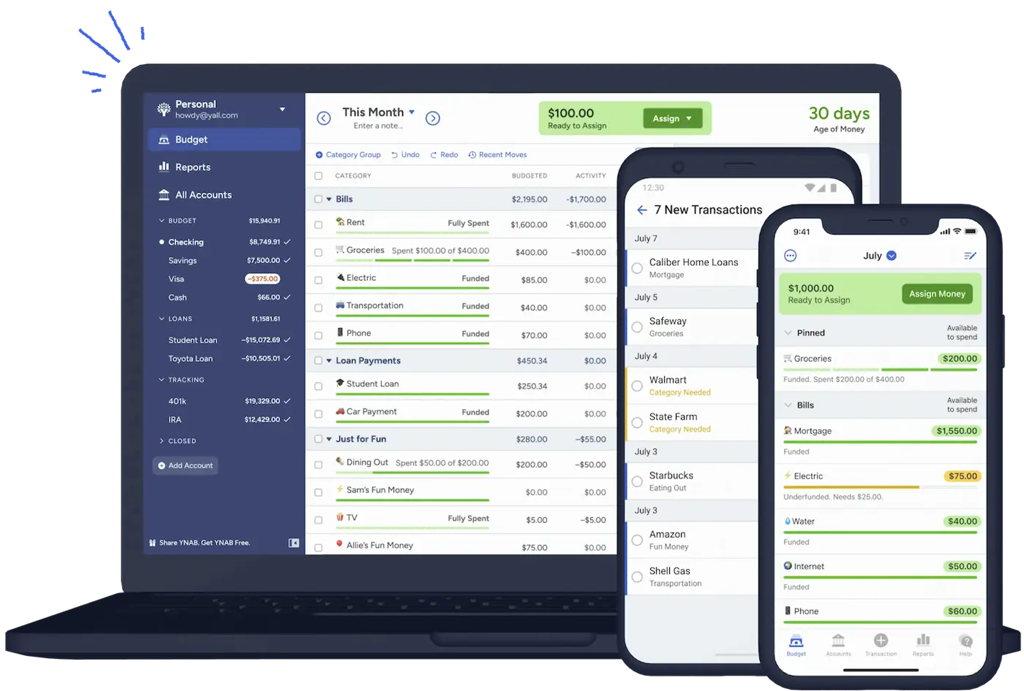

The primary rule of the YNAB method involves giving every dollar a job. You only look at the money currently sitting in bank accounts. Do not count future pay checks or expected tax refunds for this step. Every available cent needs a clear assignment within the digital budget. This practice creates a finite boundary for all spending decisions. It forces a direct confrontation with the reality of available liquid resources.

Address Immediate Obligations and Daily Essentials

The first group of dollars should cover basic survival needs. You assign funds to rent or mortgage payments immediately. These dollars also handle utility bills and necessary grocery trips. Use short sentences to define these non-negotiable monthly costs. Electricity and water must stay active for a functional home. Transportation costs like gas or bus fares require dedicated funding. This initial layer of the budget ensures a safe living environment.

Prepare for Sinking Funds and Irregular Expenses

True expenses are those predictable costs that happen infrequently. Real life involves car repairs and annual insurance premiums. You should treat these distant events like monthly bills today. Break down a large yearly cost into small monthly assignments. This strategy prevents a massive financial shock when the bill arrives. Your budget absorbs the impact of a new set of tires easily. This proactive habit is a hallmark of the ynab method. You stop relying on high interest credit cards for emergencies. Every month a few dollars join the car maintenance category. This slow accumulation of wealth creates a powerful financial safety net. Company name YNAB helps users visualize these future needs with ease.

Adjust the Plan for Changing Life Realities

No budget remains perfect for an entire month without changes. Unexpected events happen and priorities shift for various valid reasons. You might spend more on groceries than originally planned. Simply move dollars from a less important job to cover the gap. This flexibility is what makes a spending plan actually sustainable. You do not fail when a specific category runs out of money. You just reassign existing funds to meet the new demand.